Based on housing sales numbers released last week, real estate professionals across the Puget Sound breathed a collective sigh of relief.

The news?

For the first time since October 2005, year-over-year single-family home (SFH) sales volumes in King County stopped falling. The 1,655 closed sales represents a 4 percent increase over June 2008.

Since sales activity peaked in 2004 (4,359 SFH and condos combined) and median prices peaked in 2007, King County has seen a slow, steady decline in both (the year-over-year measure is often used as a comparison because it accounts for the seasonal nature of home purchasing habits).

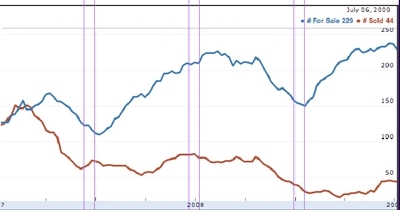

And the effects are also being seen in Mercer Island.

According to a year-end real estate broker’s report by the Northwest Multiple Listing Service (NWMLS), only 196 properties were sold here in 2008, a 34 percent drop from 2007. The halt in sales declines, indicates the demand for housing remains, albeit in a weakened state compared with years past.

Local Managing Broker E.J. Bowlds of Coldwell-Banker Bain said he’s never seen the market so slow. Since starting on Mercer Island as a Broker in 1989, he compared the current slow-down to the 1990 housing slump, but said the current sales slump was much longer.

“But it wasn’t as dramatic as this time,” he said.

“We’ve been a slower market for 18 to 20 months now.”

Bowlds was, however, cautiously optimistic about the volume and types of homes sold here. According to the approximately 240 listings on the Island last week, he reported “decent activity” in sales in the $1 to $2 million range. About 20 percent of the listings fall into this category.

“That’s kind of the sweet spot,” he said.

Some indications are that while sales (24 sales closed in June) are holding steady or are slightly better here than last year, sellers are beginning to tire of holding on to their properties.

According to Tim Ellis, publisher of the bearish real estate blog SeattleBubble.com, about 50 percent of listings taken off the NWMLS listings over the last 90 days on Mercer Island saw at least one price reduction.

“I think the ‘softness’ of prices in a high-end real estate market like Mercer Island will be largely determined by the number of ‘must-sell’ homes,” he said.

The median sales price here for all properties sold through the end of 2008 is $1,025,000 according to NWMLS numbers, only 5 percent less than the $1,080,000 median price for 2007. But so far in 2009, the median price has continued to drop, falling below the $1 million benchmark.

Usually considered the peak of the seasonal real estate buying season, median price numbers for the summer months so far are showing a decline in price. The median price for Mercer Island fell nearly 16 percent between June 2008 and June 2009 to just over $900,000.

Bowlds said he believed that eventually, an equilibrium would be reached and prices would stabilize and see modest growth in the future. That depends, however, on no further disruptions in the market similar to those seen in 2007 and 2008.

Not all real estate sold here are seeing big price reductions, such as a five-bedroom, five-bathroom beauty at 7406 N Mercer Way, sold on June 8 for $5,950,000. The McGilvara neighborhood estate was reportedly purchased by a Microsoft executive. But a cursory search through online real estate service Redfin of listings for “recently sold properties” here appears to show a large number of home sold below $1 million.

On the other end of the spectrum was a five-bedroom, two bathroom Mercerdale home at 3424 76th Place SE. It was purchased for $366,000 on June 23.

“Prices are lower and the longer they remain down the more people will come out to buy,” he said.